Did you ever imagine one day you could walk out of a dealership with a brand new, fully financed car in a matter of moments?

Or, that you could interact with a virtual bank manager when withdrawing money from your local ATM?

Well, when 5G technology gets widely implemented, such financial processes are going to become streamlined and near-instant.

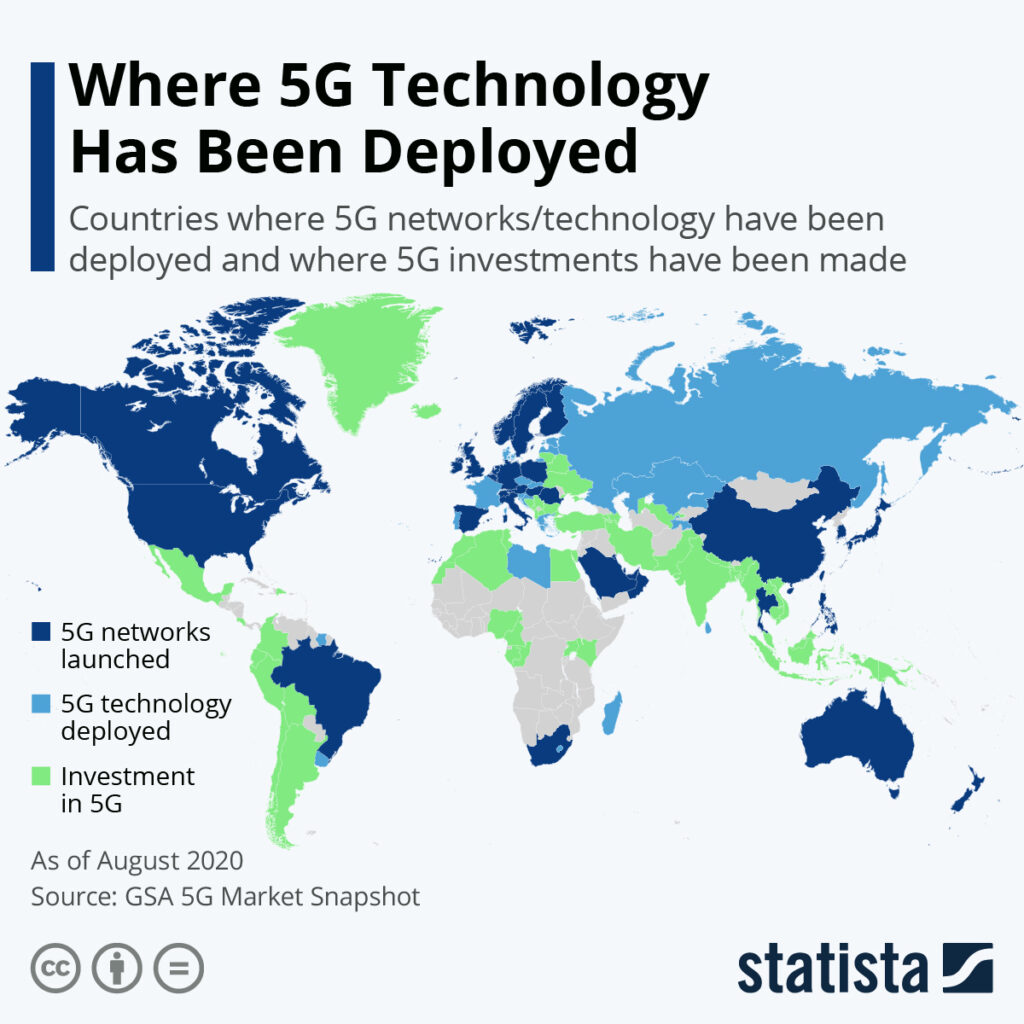

India Catching Up to Global Adoption

That day we hinted at earlier could be here sooner than you think.

The latest GSA data revealed that 5G adoption has shown rapid growth in a few months. Sixty-one countries around the world are already using 144 commercial 5G networks as of January 2021. The same report states that over 400 operators in 131 countries are actively investing in 5G networks.

Although India is currently left out of these lists, telecom players and smartphone makers are well on their way to begin operations. For example, Airtel and Reliance Jio are optimistic about a 5G rollout as early as the second half of 2021.

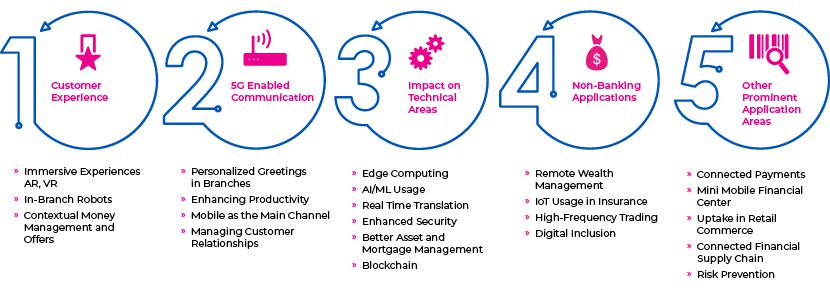

How Will the Financial Sector Benefit from 5G?

As an early adopter of digital technology, the finance sector stands to gain a great deal with 5G. Its use will enable agile finance companies to deliver new and innovative services to consumers.

Here are some of our top picks out of the plethora of improvements in store for the financial sector:

1) Swifter and More Efficient Banking Services

5G’s enhanced speeds will open up new doors to faster banking. That means faster in-branch services, end-to-end cycle times, investment trading, money transactions and stock exchanges. Even the more complicated operations like credit checks for big-ticket purchases, mortgages and loan approvals will go much faster.

Insurance providers will be able to serve customers and resolve claims even more quickly, potentially almost in an instant.

This will push consumers’ demands for faster online services, like when they’re opening an account or ordering a credit card, etc.

5G technology will help financial institutions build more efficient banking applications and websites. With almost all the data being stored in the cloud, consumers will experience faster and more seamless usage.

The spread of the Internet of Things (IoT) alongside 5G will lead to better customer interactions. Money operations won’t slow down in densely populated areas thanks to its high connectivity.

2) Emergence of Pop Up Branches

Think about the bank coming to you, instead of vice versa.

5G will provide the connectivity for portable “micro branches” to take banking services directly to even the most remote locations. By doing this, banks will be able to innovatively connect with new demographics and provide services to disaster-affected areas, college campuses, large events and more.

The speed and responsiveness of 5G will someday enable the simultaneous wireless functionality of next-generation ATMs and other self-service kiosks. These devices will use technologies like Artificial Intelligence-assisted self-service, contactless interfaces with facial recognition and e-signature capabilities. In a post-crisis world, these features will be highly sought after.

For example, PNC Banks in America set up pop-up branches for students on the West Virginia University campus.

3) AR/VR To Revolutionize the Customer Experience

The high-speed, bandwidth and low latency of 5G plus cloud computing will work together to create a revolutionary impact on Augmented/ Virtual Reality (AR/VR) applications.

It’s not hard to imagine a future where virtual assistants or chatbots will provide engaging customer service via audio, video or in several languages.

For example, Banco Santander of Spain is already using 5G technology and edge computing to allow customers to virtually visit their office and café in Madrid.

Axis Bank, one of India’s leaders in banking, has adopted AR in its mobile application. Customers can use the “AR View” to get the details and directions to nearby branches and ATMs.

4) Wearable Devices

A particularly promising pivot 5G will provide in financial services is wearable devices.

Wearables like watches are already an important channel for mobile payments today, and this is likely to increase even more in the future.

To create an omnichannel experience for consumers, banks are already extending their services to wearables, VR devices and IoT devices.

These wearables can someday efficiently offer customers real-time transaction updates, balance notifications, or facilitate stock transactions by simply tapping their devices.

Wearables benefit financial institutions by providing increased security.

By connecting to the cloud using 5G technology, these wearable devices will be able to share data with banks with even more reliability and lower latency than ever imagined.

Recently, ABN AMRO, the Dutch bank began testing out wearable devices like smart rings, watches, and bracelets as a potential new NFC payment method.

The Time is Now

It’s not too late for financial institutions like yours to start building robust strategies and execution plans to roll out 5G-enabled services.

Because of the pandemic, the average Indian consumer’s demand for faster, secure and seamless digital experiences is at an all-time high – and continuing to rise.

So, step up your game by embracing innovation and deploying proactive marketing campaigns to mark your lead in the 5G transformation.

HT Media’s digital channels allow you to connect directly with your target audience, right on their smartphone screens. More than 139 million people trust and engage with our digital news websites like hindustantimes.com, livehindustan.com and livemint.com on a monthly basis. To know more about the customized solutions we can offer your brand, reach out to us here.

Ready to take your brand to the next level? Connect with us today to explore how HT Media can amplify your presence across our diverse portfolio of 25+ brands and properties. Let's turn your brand vision into reality!

Comment