“Contactless payments” and “social distancing” are the new buzzwords on everybody’s lips these days.

When most business sectors resorted to curtailing ad spends, financial institutions seem to take a different route. Instead, finance brands are going the extra mile to reach out to their audience.

Banking is a crucial service, and especially during times of crisis, its services need to be made available for people of all social and economic backgrounds.

There has been a strategic shift from “marketing” to “communication”, as BFSI brands are creating need-based solutions that address problems and offer support to customers during this time of crisis.

By doing this, their aim is to close the information gap with customers as premium deadlines, market shares and personal finance are all being thrown into disarray everywhere.

What BFSI brands have done

Major banks and financial institutions across India like HDFC, ICICI, Future Generali India and DSP Mutual Funds have leveraged different mediums, from digital to traditional, to:

- keep their brand relevant with brand-based communication,

- discuss products and solutions to help customers,

- stay up-to-date with the conversation surrounding COVID19.

A prime example of some offline strategies being engaged are mobile ATM vans and reduced staff at physical bank branches.

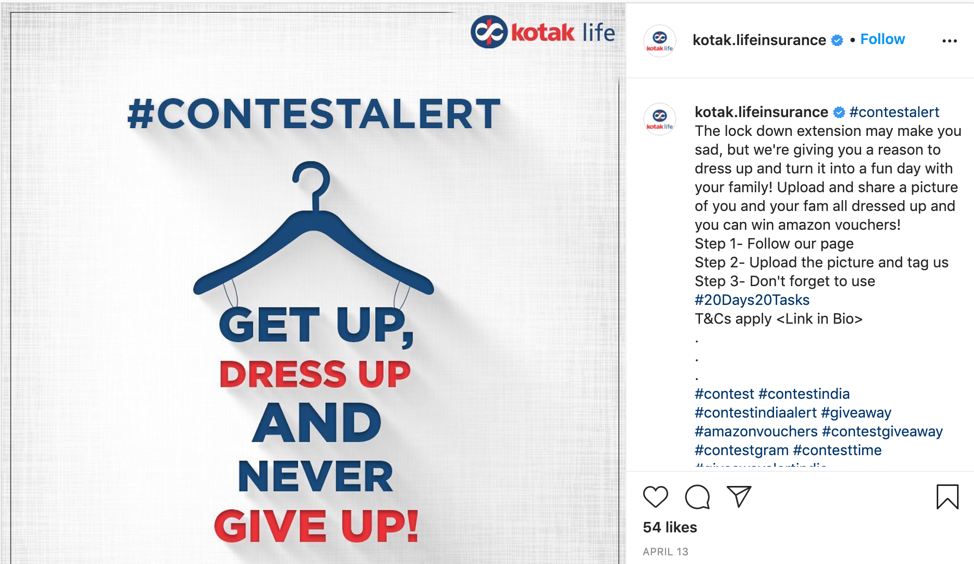

On the digital front, social media is being strongly embraced as tools used by finance brands to communicate better with their audience.

Some tactics that have been adopted are:

- Customer-centred contests,

- Pandemic precaution tips,

- Educational content about fraud and policies,

- Answering customer FAQs.

Three Essential Digital Steps

It’s crucial for financial organizations to keep their fingers on the pulse of their users. They need to effectively communicate how they will continue to engage with these customers in the post-pandemic business environment.

But how should they do that?

There are many digital components that can help your BFSI brand grow and redefine customer satisfaction during this pandemic. Let’s break down three of them in this blog:

1) Go Mobile

A mobile-friendly application and website are pre-requisites for any business nowadays, banks included.

A survey conducted by Lightico revealed that more consumers will try digital apps for their financial activities now, more than ever.

That’s why an optimized and well-designed mobile platform must be leveraged to share real-time information with your account-holders. To make them feel cared about, they can also use the app for sending bill payment reminders, account updates, and other pertinent/ useful information.

In-app marketing can be further used to promote ancillary products and services such as phone recharges, credit card payments and insurance premiums. These apps will also go a long way in delivering a highly personalized experience.

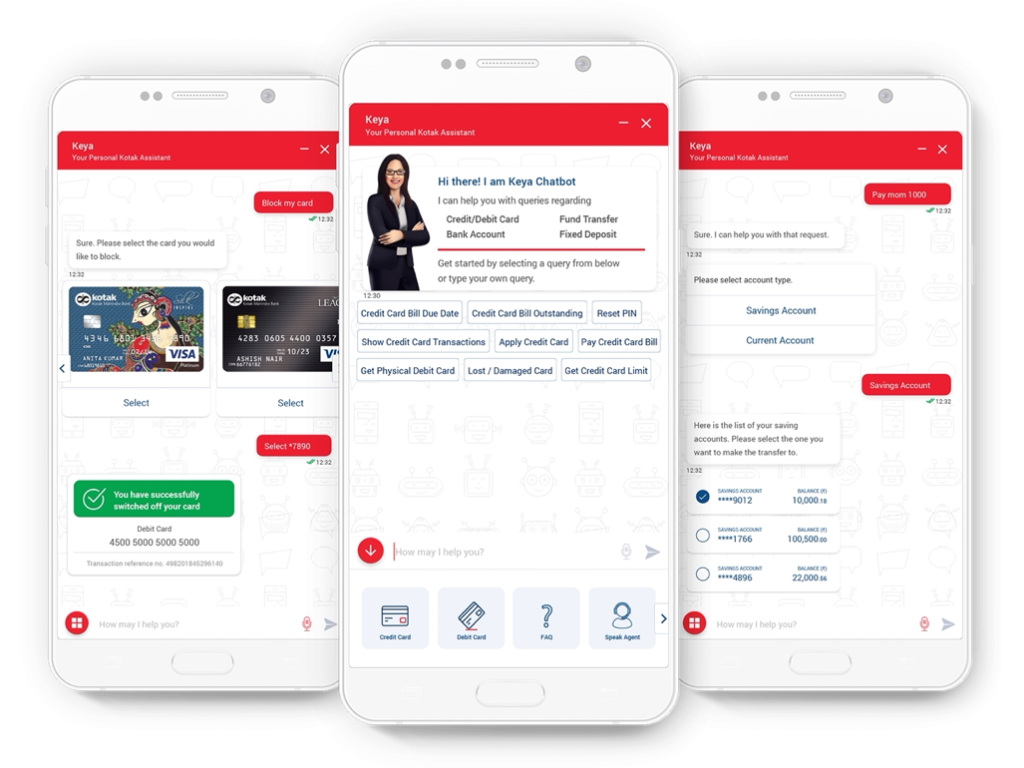

2) Chatbots

Consumers these days want to get answers to their queries quickly and effortlessly. Helplines and customer service are still essential, but they are limited in their capacity.

That’s where chatbots come in: integrated into your social media, apps and websites.

In fact, chat is one of the fastest-growing aspects of customer support, and is ideal for queries ranging from the simple to the complex, ATM locations, account status, service requests and a host of other uses.

These virtual assistants can offer your customers service 24/7 and are often powered by AI. ICICI’s chatbot iPal can address over 1.5 million queries a month.

Programming your chatbot to converse in vernacular languages, like Kotak Mahindra Bank’s Keya (who can communicate in Hindi) will go a long way.

3) Digital Advertising through Customer Segmentation

India is a diverse country, both demographically and geographically. Therefore, catering your services to this heterogeneous customer base can be a challenge.

Most customers belong to rural areas and not just the metros or tier 1 cities. The challenge: to identify who your customers are and what channels you can use to best reach out to them.

A smart digital marketer will cut through the advertising noise of other big brands by selecting and targeting a specific sub-section of consumers who share the same pain point.

Conducting a smart segmentation of your customers while planning for your next campaign ensures that you’re only sending them the most relevant content on their preferred channels.

Technological advancements like AI-based algorithms are now being leveraged to automatically segment customers based on certain factors.

We Can Help

Investing in digital advertising delivers that personalized messaging to your customers. Wondering where to start? Hindustan Times Media’s Digital news properties including hindustantimes.com, livehindustan.com and livemint.com, have their finger firmly on the collective pulse of India and brings in more than 139 million unique visitors to their websites. Find out more about partnering with us here.

Ready to take your brand to the next level? Connect with us today to explore how HT Media can amplify your presence across our diverse portfolio of 25+ brands and properties. Let's turn your brand vision into reality!

Comment